Myanmar’s government recently gave the go-ahead to some of the largest power projects in recent years, but it now faces a major short-term challenge – providing the country’s immediate energy needs.

By THOMAS KEAN & KYAW YE LYNN | FRONTIER

BILLIONS of dollars, thousands of megawatts: the government’s recent decision to green-light four power projects was the biggest development in the sector for several years.

But in the background, the Ministry of Electricity and Energy is dealing with a more immediate problem: How to meet Myanmar’s growing short-term power needs without blowing the budget.

On January 5, it announced a tender for two rental power projects in Mandalay Region, at Myingyan and Kyaukse, with the winning bidders to be granted a five-year concession.

The new plants will replace rental power projects operated by British firm Aggreko (95 megawatts) and APR Energy (102MW) from the United States. In place since 2014, these contracts were shorter – from 12 to 18 months – and have already been extended several times.

Support more independent journalism like this. Sign up to be a Frontier member.

U Han Zaw, chief engineer at the Electric Power Generation Enterprise, told Frontier that the tender should result in a lower tariff and more efficient power generation. He said the longer contract on offer would also “create a level playing field” by enabling more companies to participate.

“The shorter the contract, the higher the tariff,” he said. “So we decided to go with a five-year contract as we want to buy electricity at a cheaper price.

“We have extended the contracts for these plants three times so the engines may not be in good condition, or not very efficient. We want to upgrade them.”

The new plants will have a combined installed capacity of 225MW. Like the APR and Aggreko projects, they will be fuelled by Myanmar’s allocation of natural gas from the Shwe field.

This allocation, known as the domestic off-take, is presently 100 million cubic feet a day. But Han Zaw said the Ministry of Electricity and Energy was negotiating with the field’s developers to receive another 50 million cubic feet a day to enable it to meet Myanmar’s growing power needs.

Strong interest

At least 20 bids, mostly from local companies, have already been submitted to the tender evaluation committee and Han Zaw said that because of the strong interest the ministry has extended the original deadline from February 19 to March 6.

A condition of the tender is that the plants must be ready to operate by the end of February 2019, Han Zaw added.

The existing contracts are due to expire at the end of April 2018. However, Han Zaw acknowledged the timing might create problems meeting power needs in May, when the hot weather pushes up demand and hydro dam reservoirs are at their lowest levels.

“If there is an urgent need to do so, we will extend the existing contracts for two or three months,” he said.

APR did not respond to a request for comment. Its partner at Kyaukse is Supreme Group, which the government recently selected to undertake a US$2.4 billion liquefied natural gas power project in Ayeyarwady Region.

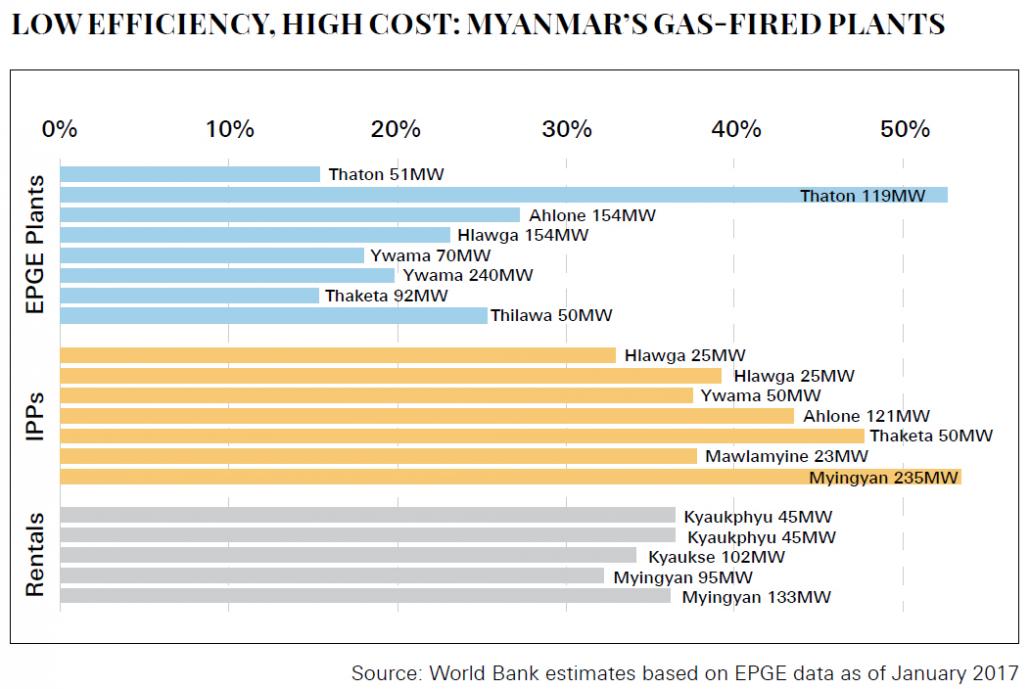

An overview of Myanmar’s gas fired power plants. (Frontier)

Supreme executive director U Htu Htu Aung said the company was still considering whether to submit a bid. “If we participate it will be a joint bid [with APR] or supporting APR,” he added.

“We trust that the successful bidders will be carefully chosen by the ministry not only based on price,” he said.

The ministry should also consider their track record and experience operating similar power plants, and their credibility and reputation, he said. The limited timeframe for implementation and the potential impact of any delay on national electricity supply also made the bidder’s financial capacity important, Htu Htu Aung added.

Mr Jeremy Mullins, research director at Myanmar Energy Monitor, confirmed there had been “a great deal of interest” in the two tenders.

“This should help Myanmar get a deal on favourable terms. It also highlights the expanded role the private sector can play in bringing electricity generation solutions to Myanmar, given the chance,” he said.

Rental power and IPPs

Nearly all of Myanmar’s power comes from hydro and gas-fired plants: In 2016-17, hydro plants provided about 55 percent of Myanmar’s power, while gas plants provided the rest.

Prior to 2011, all gas-fired plants were run by EPGE. But a partial liberalisation of the sector under the U Thein Sein government resulted in private players entering the market.

Initially, this was in the form of independent power projects (IPP). The investors signed a power purchase agreement with the government under which it undertook to buy power at a specific price over a specific period, normally 20 or 30 years.

For a range of reasons – including the risk of entering a newly opened market like Myanmar – these early PPAs were expensive, with the terms favouring the private developers.

Workers install high-voltage transmission lines in Ann Township, Rakhine State. (Teza Hlaing | Frontier)

Aside from the cost, a particular condition of the contracts – that if the government was unable to supply the privately run plants with enough gas, it would still have to pay for the cost of the unused generating capacity – made the ministry reluctant to commission more gas-fired IPPs.

In a November 2017 report, the World Bank said that because of this clause the government had more recently prioritised rental power plants, which have much shorter PPAs.

In February 2014, the government signed the original contract with APR, while Aggreko installed its Myingyan plant early the following year. Three rental power contracts with Hong Kong-based VPower have since been signed, for 90MW at Kyaukphyu and 133MW at Myingyan.

Rental projects would normally be the most expensive option, due to their short-term nature. But the report – a project information document for the proposed upgrade of the Ywarma gas plant – detailed how the five rental plants in Myanmar actually had the lowest generation costs due to the low efficiency of state-run plants and the unfavourable terms of the early IPP projects.

The thermal efficiency at plants run by EPGE ranges from about 15 percent to 27 percent, whereas for IPPs the figure is 33 percent to 53 percent. That means that for the same amount of gas used, the 235MW Myingyan IPP will generate four times as much power as the 92MW Thaketa EPGE plant.

For a country with limited natural gas available for domestic use, improved efficiency could make a huge difference. The World Bank is providing support to upgrade state-run gas plants; a 119MW plant with nearly 53 percent thermal efficiency is scheduled to come online early next year at Thaton in Mon State.

It is expected to triple annual output, to 770 GWh, while reducing carbon dioxide emissions and fuel consumption.

“Upgrading only state-owned gas plants to international level of efficiency have been estimated to save more than US$150 million per year in operating costs,” the World Bank report said.

But upgrades and rental agreements will only go so far towards meeting Myanmar’s power needs.

While noting that rental power projects to date have “generally been successful at getting electricity generation off the ground quickly, when and where it’s needed”, Mullins from Myanmar Energy Monitor said such agreements “are not an ideal long-term solution”.

“The private sector wants to see the government address the issues that are holding back investment in long-term IPPs, such as sovereign guarantees and negotiation of power purchase agreement,” he said.

The recent decision to issue “notices to proceed” to four developers for projects totalling 3,000MW was widely considered a positive step in this direction, but there are many other potential power projects that have been unable to move forward for various reasons.

Han Zaw said the recent developments in the sector, including issuing the notices to proceed and announcing tenders, were the result of years of planning and negotiations with investors.

“We’ve been criticised for some of our decisions but we have to do it because we can’t waste any more time – electricity demand is rising year by year,” he said. “But I have to admit that it was also pushed by policymakers who realised that LNG was the only power source to meet demand in the short term.”

TOP PHOTO: A Ministry of Electricity and Energy worker pulls a cable during the construction of transmission lines in Ann Township, Rakhine State. (Teza Hlaing | Frontier)